The volume in the crypto industry has also dropped sharply in the past few days. According to CoinMarketCap, trading volume dropped 12% over the last 24 hours to $100 billion.

Most importantly, futures open interest has retreated to $96 billion, down from last year’s high of over $255 billion. Falling futures open interest is a sign that investors are continuing their deleveraging, which often leads to lower crypto prices.

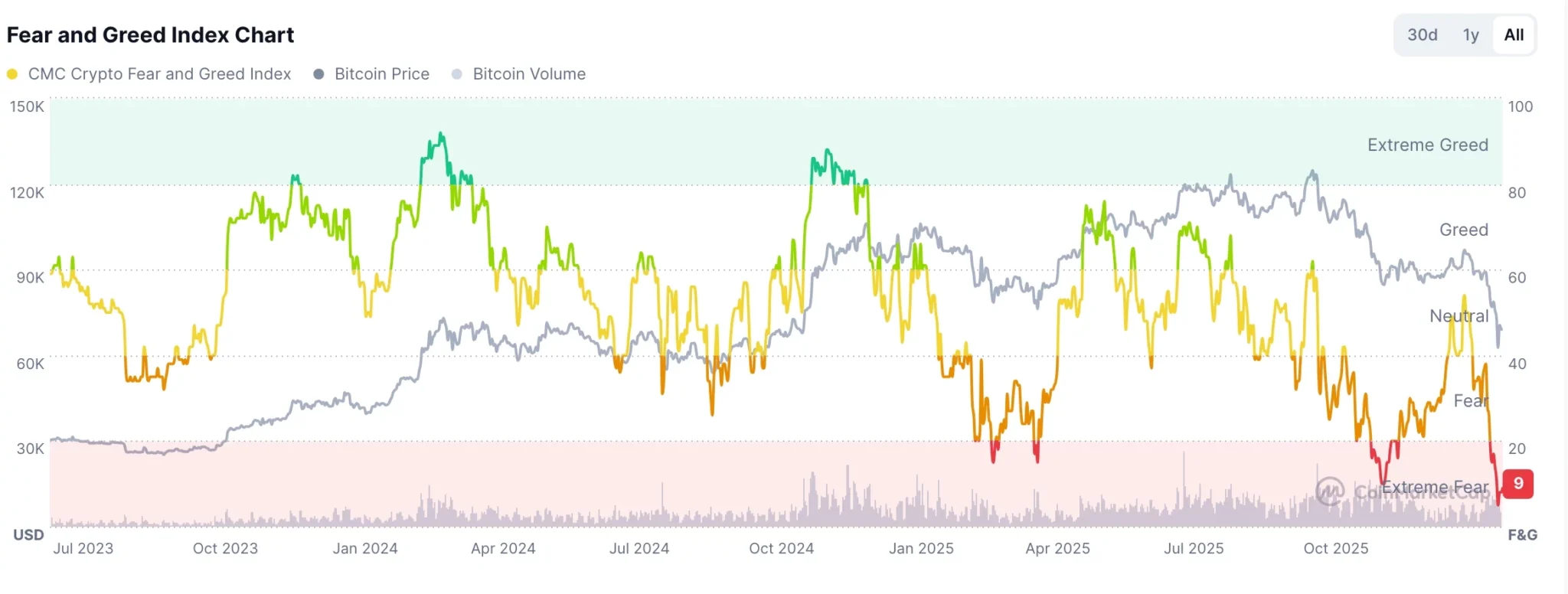

The Bitcoin price is struggling amid persistent selling pressure in the crypto market. Key support and resistance levels are under scrutiny as traders weigh the next move.

This Bitcoin price prediction assesses the market’s current structure, potential upward moves, and downside risks.

Current market scenario

As of February 9, Bitcoin btc0.59%Bitcoin is trading near $68,388.46, down about 2.73% over the past 24 hours. Price remains range-bound between $68,000 and $70,000, signaling consolidation after the volatility earlier this year. Strong buying near $60,000 has highlighted the market’s resilience despite the recent pullback.